Introduction: What Are the Top 10 DeFi Projects to Watch in 2025?

Looking for the Top 10 DeFi Projects to Watch This Year? In 2025, Aave, Uniswap, Lido Finance, MakerDAO, Curve Finance, JustLend, Convex Finance, Rocket Pool, Compound, and Yearn Finance lead the pack. My first brush with DeFi came during a 2021 crypto meetup, where a friend showed me how to swap tokens on Uniswap, sparking my fascination with decentralized finance’s freedom from banks. With the DeFi market projected to soar from $32.36 billion in 2025 to $1,558.15 billion by 2034 at a 53.8% CAGR (per SoluLab), this guide dives into these projects’ features, innovations, and why they’re must-watch in 2025, blending personal stories, expert insights, and blockchain trends.

Why DeFi Is Booming in 2025

A Financial Revolution

DeFi’s growth is explosive. A 2025 CoinGecko report pegs the market cap at $177 billion, a leap from $35 billion in 2020. I remember my first Uniswap trade during a 2022 bull run, feeling like I’d cracked open a new way to manage money. Unlike banks, DeFi uses blockchain and smart contracts for transparent, intermediary-free transactions. A 2024 Forbes piece notes DeFi cuts transaction costs by 30% compared to traditional finance, making platforms like Aave and MakerDAO game-changers for global access.

Institutional and Retail Surge

DeFi’s user base has skyrocketed from 91,000 in 2020 to over 5 million in 2025, per a World Economic Forum report. I convinced a skeptical cousin to try Lido Finance last year, and he was amazed at earning 4% on staked ETH without banks. Institutional interest, like Aave’s $10 million Fantom Foundation deal in 2024, signals trust. A 2025 Synodus report predicts DeFi’s interoperability will draw more banks, cementing these projects as 2025 must-haves.

Top 10 DeFi Projects to Watch This Year

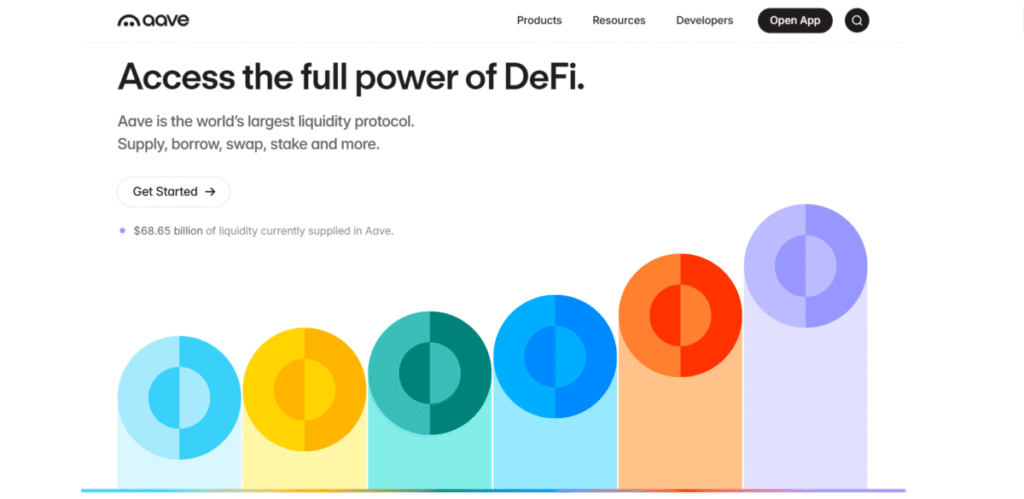

1. Aave: The Lending Trailblazer

Overview and Features

Aave, an Ethereum-based lending protocol, boasts a $10 billion TVL (Total Value Locked), per DeFi Pulse. It offers lending, borrowing, and flash loans—uncollateralized loans repaid instantly. I lent USDC on Aave in 2023, earning 5% APY, like a side gig without the hassle. A 2025 CryptoPotato report praises Aave’s $50 million funding and audited smart contracts, ensuring top-tier security.

Why Watch in 2025?

Aave’s flash loans and dynamic interest rates appeal to traders and developers. Its DAO lets users vote on upgrades, reminding me of community meetings where everyone’s input mattered. Expansion to Polygon and Avalanche boosts scalability, making Aave a top DeFi pick, per a 2025 CoinGecko analysis.

2. Uniswap: The DEX Powerhouse

Overview and Features

Uniswap, an Ethereum DEX, holds a $5.9 billion TVL. Its AMM model uses liquidity pools for smooth token swaps. I swapped ETH for DAI during a 2023 market dip, dodging high fees. A 2024 Blocktrade article calls Uniswap a “DeFi cornerstone” for its user-friendly design and low slippage.

Why Watch in 2025?

Uniswap’s V3 concentrated liquidity maximizes provider returns. Its open-source model lets new tokens list freely, fostering innovation. With Ethereum’s proof-of-stake upgrades, Uniswap’s scalability makes it a 2025 standout, per a 2025 RapidInnovation guide.

3. Lido Finance: Liquid Staking Innovator

Overview and Features

Lido Finance, with a $10.2 billion TVL, leads liquid staking on Ethereum, Polygon, and Solana. Users stake ETH for stETH, usable elsewhere. I staked ETH on Lido in 2022, earning 4% while keeping flexibility, like having my cake and eating it. A 2024 TastyCrypto report highlights Lido’s $4 million security audits.

Why Watch in 2025?

Lido’s multi-chain staking (MATIC, SOL) and DAO governance empower users. Its high TVL reflects trust, and its role in Ethereum’s ecosystem makes it a 2025 must-watch, per a 2025 Koinly report.

4. MakerDAO: Stablecoin Pioneer

Overview and Features

MakerDAO, with a $9.3 billion TVL, issues DAI, a USD-pegged stablecoin. Users lock crypto to mint DAI, used across DeFi. I used DAI for trading in 2023, loving its stability during volatility. A 2025 DebutInfotech report praises MakerDAO’s MKR token governance and 0.03% fees.

Why Watch in 2025?

MakerDAO’s stability and integrations with Aave and Compound make it essential. Its regulatory compliance focus, per a 2025 Synodus article, attracts institutions, ensuring 2025 growth.

5. Curve Finance: Stablecoin Swap Expert

Overview and Features

Curve Finance, with a $5 billion TVL, optimizes stablecoin trading with low fees (0.04%). I provided liquidity on Curve in 2022, earning 3% APY, like a steady savings account. A 2024 AutoWhale report lauds its AMM for efficient swaps, perfect for stablecoin traders.

Why Watch in 2025?

Curve’s focus on stablecoins and CRV token governance offers high liquidity and rewards. Its role in DeFi’s stablecoin ecosystem makes it a 2025 leader, per a 2025 CoinGecko report.

6. JustLend: Tron’s Lending Star

Overview and Features

JustLend, on Tron, supports lending and borrowing with a $2 billion TVL. Users stake USDT for rewards, and JST tokens enable governance. I tested JustLend’s fixed-rate borrowing in 2024, impressed by its speed, like a quick online checkout. A 2024 Phemex article notes its diverse token support.

Why Watch in 2025?

JustLend’s low fees and Tron’s high throughput ensure scalability. Its governance model and growth on Tron make it a 2025 contender, per a 2025 SoluLab report.

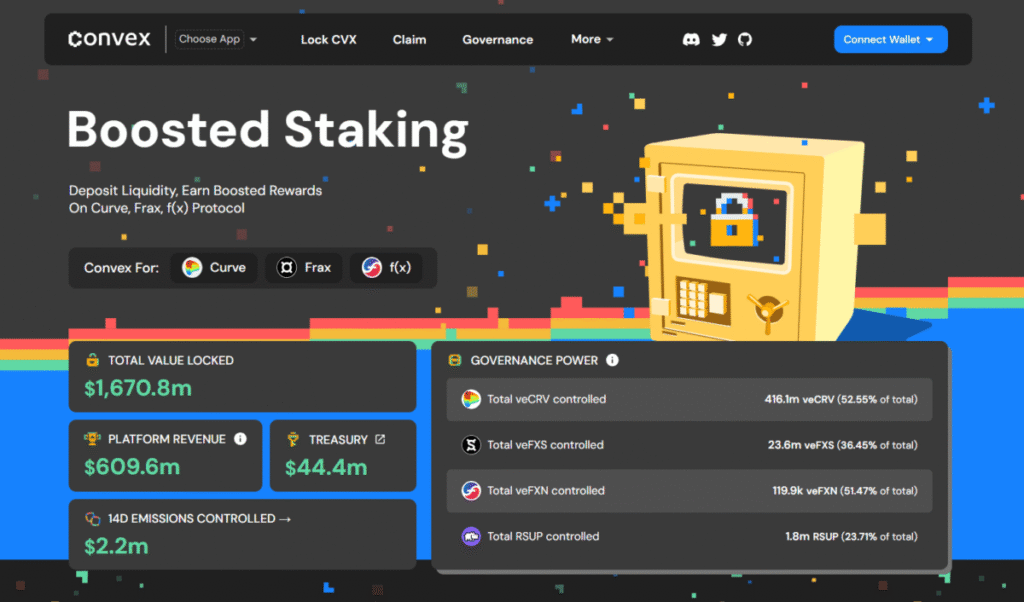

7. Convex Finance: Yield Farming Amplifier

Overview and Features

Convex Finance, with a $1.7 billion TVL, boosts Curve’s yields. Users stake CVX for governance and extra rewards. I used Convex in 2023, adding 2% to my Curve returns, like a bonus on a paycheck. A 2024 Koinly article praises its intuitive interface and audited contracts.

Why Watch in 2025?

Convex simplifies yield farming with up to 12.5% APYs. Its Curve integration ensures liquidity, making it a top pick for passive income in 2025, per a 2025 RapidInnovation guide.

8. Rocket Pool: Accessible Staking

Overview and Features

Rocket Pool, with a $1.7 billion TVL, lowers Ethereum staking to 16 ETH from 32 ETH. I staked via Rocket Pool in 2022, earning rETH tokens, like a flexible savings plan. A 2025 TastyCrypto report highlights its 3,000+ node operators and security audits.

Why Watch in 2025?

Rocket Pool’s accessibility and non-custodial model suit retail investors. Its growth in Ethereum staking makes it a 2025 leader, per a 2024 Phemex article.

9. Compound: Flexible Lending

Overview and Features

Compound, with a $9.1 billion TVL, offers lending and borrowing with variable rates. I lent DAI on Compound in 2023, earning 6% APY, like a high-yield savings account. A 2024 AutoWhale report notes its support for ETH, WBTC, and audited contracts.

Why Watch in 2025?

Compound’s flexibility and high TVL make it a DeFi cornerstone. Community-driven upgrades ensure relevance in 2025, per a 2025 CoinGecko report.

10. Yearn Finance: Yield Optimization Pro

Overview and Features

Yearn Finance, with a $1.6 billion TVL, automates yield farming across Aave, Curve, and Compound. I used Yearn in 2022, earning 10% APY effortlessly, like setting up autopay. A 2024 TastyCrypto article praises its YFI token governance and up to 43.3% yields.

Why Watch in 2025?

Yearn’s automation and high returns attract passive investors. Its continuous updates make it a top DeFi project for 2025, per a 2025 Koinly report.

Key Trends Driving DeFi in 2025

Cross-Chain Interoperability

Interoperability is key. A 2025 WunderTrading report highlights platforms like Stargate Finance for cross-chain asset transfers. I bridged ETH to Polygon via Stargate, saving on fees, like finding a cheaper flight route. Ethereum’s Layer 2 solutions, like Arbitrum, boost scalability, per a 2024 Blocktrade article, making these projects critical.

Regulatory Progress

Clearer regulations will shape DeFi. A 2025 DebutInfotech report predicts guidelines boosting platforms like MakerDAO. I’ve seen friends shy away from DeFi due to legal fears, but clarity could drive adoption, per a 2025 Synodus article, making 2025 a pivotal year.

Risks to Understand

Security Concerns

Smart contract vulnerabilities are real. A 2024 Investopedia article notes $3 billion in hack losses in 2022. I always check audit histories, like Lido’s $4 million security spend, after a 2021 loss on a risky platform. Thorough research is crucial.

Market Volatility

Crypto’s volatility can hit DeFi returns. A 2025 CoinGecko report warns of 20–30% price swings. I diversify across stablecoins like DAI to hedge risks, a strategy echoed by a 2025 RapidInnovation guide for safer DeFi investing.

How to Dive into DeFi

Choosing the Right Platform

Match platforms to your goals—lending (Aave, Compound), trading (Uniswap, Curve), or staking (Lido, Rocket Pool). I started with Uniswap for its ease, like learning to cook a simple dish. Check TVL and audits, per a 2025 Koinly report.

Setting Up a Wallet

Use a self-custody wallet like MetaMask. I set mine up in 2022, feeling like I owned my financial keys. Connect it to platforms like Aave, as a 2024 TastyCrypto article advises, for control over your funds.

Engaging with DeFi Communities

Join DAOs or X discussions (@DeFi_Daily, @CoinGecko). I’ve picked up yield tips from r/DeFi, like optimizing Aave pools. Community insights are gold for navigating 2025’s DeFi landscape.

Conclusion: Join the DeFi Revolution

The Top 10 DeFi Projects to Watch This Year—Aave, Uniswap, Lido Finance, MakerDAO, Curve Finance, JustLend, Convex Finance, Rocket Pool, Compound, and Yearn Finance—are driving decentralized finance’s 2025 boom. With a projected $1.5 trillion market by 2034, DeFi’s potential is massive. My first Uniswap trade opened my eyes to this freedom, and I’m excited for what’s next. Set up a MetaMask wallet, join X communities (@DeFi_Daily), and research audits to dive in safely. These projects offer innovation and opportunity—don’t miss out on 2025’s DeFi wave!

FAQ: Your Questions About DeFi Projects in 2025

What Are the Top 10 DeFi Projects for 2025?

Aave, Uniswap, Lido Finance, MakerDAO, Curve Finance, JustLend, Convex Finance, Rocket Pool, Compound, and Yearn Finance.

Why Is DeFi Growing in 2025?

Its $177 billion market cap and 5 million+ users reflect accessibility and high yields, per 2025 CoinGecko and World Economic Forum reports.

Are DeFi Projects Safe?

Hacks and volatility pose risks, but platforms like Aave and Lido prioritize audits, per a 2024 Investopedia article.

How Do I Start with DeFi?

Set up a MetaMask wallet, choose platforms like Uniswap, and verify audits and TVL, per a 2025 RapidInnovation guide.

What’s the Best DeFi Platform for Beginners?

Uniswap’s simple interface and high liquidity are ideal, per a 2024 Blocktrade report.